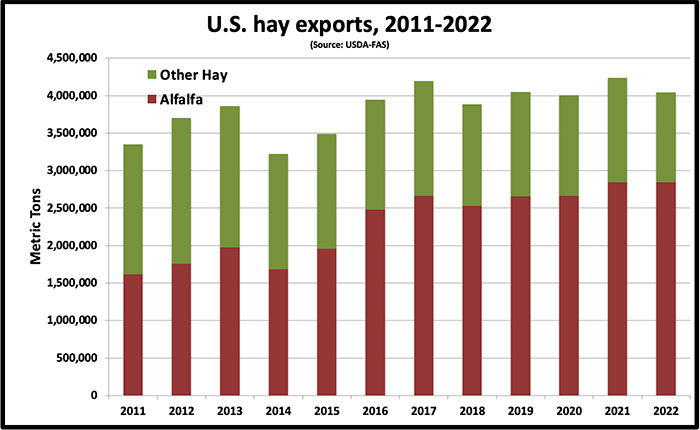

Hay exports in 2022 totaled 4.04 million metric tons (MT), which was 4.6% below 2021’s record-high level of 4.24 MT. For the fourth consecutive year and the fifth time in the past six years, total U.S. hay exports in 2022 exceeded 4 million MT based on data provided by USDA’s Foreign Agricultural Service (FAS).

The year-over-year decline in total hay exports was solely attributed to a significant reduction in grass hay exports. An unfavorable exchange rate contributed to the lower export total, although shipping rates subsided to near prepandemic levels during the calendar year.

Figure 1.

Alfalfa matches 2021

Alfalfa hay exports to all trade partners in 2022 totaled a record 2.847 million MT, barely exceeding 2021’s high-water mark of 2.846 MT.

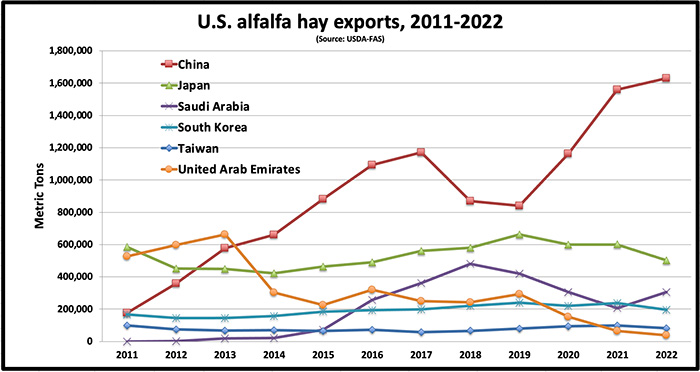

With China’s growing dairy industry and its voracious demand for high-quality alfalfa hay, that country once again set a new annual record for alfalfa hay imports from the U.S. for the second year in a row, according to USDA-FAS (see Figure 2). However, there may be one caveat. In The Hoyt Report, Josh Callen feels the China total is inflated based on other sources. If he’s right, it would drop the country’s total alfalfa hay exports to under 2021 levels and total hay exports below 4 MT.

According to the USDA estimate, which may get adjusted sometime this year, China imported 1.63 million MT of U.S. alfalfa during 2022. That was 71,083 MT (4.4%) above its updated 2021 total. The country now accounts for over 57% of all alfalfa hay exports leaving U.S. ports. Monthly export totals to China during 2022 ranged from 228,015 MT in August (a record monthly high) down to 100,013 MT in December.

China remains the major driver for enhanced alfalfa hay exports and, for that matter, all hay exports. In 2022, alfalfa hay exports to China accounted for over 40% of all U.S. hay exports, regardless of type. This is great news for Western haymakers as long as the two trade partners remain amiable with each other and China continues to favor alfalfa hay to feed its dairy cows, which is not the case in every country.

Concerning the U.S.’s major hay-trading partners not named China, the news is mostly negative. Japan, the second highest importer of U.S. alfalfa hay, finished the year by purchasing 502,799 MT, down 20% from 2021.

Saudi Arabia was a bright spot in the alfalfa hay export sweepstakes in 2022. It moved ahead of South Korea as the third leading importer of U.S. alfalfa with 304,536 MT purchased. That total was 32% higher than 2021, and the volume increase essentially matched the year-to-year deficit posted by Japan of nearly 98,000 MT.

South Korea dropped to fourth place as a leading importer of U.S. alfalfa hay, finishing the year with 195,566 MT purchased, which was a 21% drop from 2021.

Rounding out the top five U.S. alfalfa importers in 2022 was Taiwan, which now has widened the gap with the United Arab Emirates (UAE). Taiwan imported 80,938 MT of U.S. alfalfa hay, down 22% from 2021; however, it still far out-distanced the UAE with just 38,380 MT acquired during the year. The UAE had imported over 152,000 MT as recently as 2020, and up to 2013, was in the 600,000 MT range. The competition with China for U.S. alfalfa has sent the UAE looking for other trade partners.

Figure 2.

Other hay

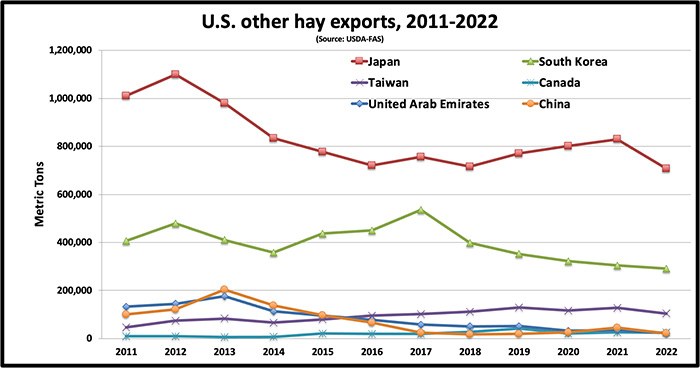

The USDA-FAS reported about 1.2 million MT of hay other than alfalfa (mostly grass) was exported from the U.S. in 2022. That was 14% fewer MT than 2021. All of the U.S.’s top trade partners imported less nonalfalfa hay than the previous year.

Japan leads all export partners for hay other than alfalfa. They imported 707,956 MT in 2022, almost 15% fewer MT than the previous year after three years of volume growth (see Figure 3).

South Korea, the distant second-leading importer of nonalfalfa hay, finished the year with a total of 291,327 MT, which was down 4.2% compared to the previous year, and the country’s fifth year in a row of declining grass hay imports from the United States.

The remaining 2022 top five export trade partners for hay other than alfalfa were Taiwan (104,465 MT, down 18%), Canada (24,568 MT, down 3%), and UAE (22,105 MT, down 36%).

China, which had previously been a significant grass hay trade partner with the U.S., imported only 21,287 MT (down over 52% from 2021).

Figure 3.

Summary

A strong dollar and some early year logistical problems helped hold hay exports in check during 2022. Still, alfalfa hay exports from U.S. ports were just slightly above 2021 on the strength of purchases by China and Saudi Arabia.

Total U.S. hay exports in 2022 exceeded 4 million MT for the fifth time in six years. China dominates the current export market, accounting for over 40% of all hay exports and more than 57% of alfalfa hay leaving U.S. ports.

Hay exports remain a small portion of total U.S. hay production. Based on USDA data for 2022, only 4% of all U.S. dry hay produced and 6.5% of all harvested alfalfa hay entered the export market.

In the seven Western states of Arizona, California, Idaho, Nevada, Oregon, Utah, and Washington, hay exports play a much larger role in impacting both markets and prices. Based on USDA export and hay production data for those states, 19% of their alfalfa production was exported in 2022 and 26% of the grass production found its way into shipping containers. As such, hay prices in the Western states play a large role in setting market prices.