Josh Callen compared the Western hay market during the past couple of years to experiencing a case of whiplash. The author of the The Hoyt Report offered his annual analysis of Western hay markets to the crowd of attendees at the Western Alfalfa & Forage Symposium last week in Sparks, Nev.

Callen noted that a perfect storm of events in 2022 led to a record-high year for hay prices. Then, this year, we got almost the perfect storm of events that led to a drastic market price demise. For example, the market analyst cited the average 2023 price for delivered hay to Tulare and Hanford, Calif., dairies was down about $60 per ton from last year while the price for lower-quality grades was off by about $120 per ton.

The perfect storm to bring hay prices down in 2023 included the downturn in hay exports caused by the high price of hay coming into the year coupled with a strong dollar. “This really killed the export market,” Callen said. “In the Pacific Northwest and Imperial Valley, where exports comprise a primary market, this had a big impact on prices compared to the previous year. Grass straw also saw a big correction in price, where some harvesters were only getting their baling costs out of it.”

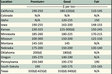

Currently, total hay exports are down about 22% from 2022. Callen noted that not only was there a 30% jump in the price of product, but there was also a 30% increase in the currency exchange rate for Japanese yen.

A second component of the perfect storm was the drop in milk prices during 2023. This softened demand from dairy farms that were just trying to weather the economic storm.

The third factor was the record wet winter in California. “This came out of left field because early forecasts were for another dry winter,” Callen said.

Finally, the wet 2023 summer in much of the West caused a lot of hay to be rained on or prevented a timely cutting. Callen noted that some areas in Nevada and Utah got double the amount of normal rainfall. Hurricane Hilary, which hit Southern California in late August, also had a substantial impact on hay growers. The wet summer brought a lot of lower quality hay to the market and really brought down the price of dry cow and feeder hay compared to the previous year.

“Most people expected hay prices to come down from their record highs — that’s just normal — but the degree they fell was a surprise, and that was precipitated by all of these other factors occurring at about the same time,” Callen noted.

Sequencing the downturn, Callen said the blood bath started last spring, but it really kicked into gear over the summer when prices seemingly dropped $10 to $20 per ton per week on some of the lower hay grades. Offering some optimism, he shared that current prices have started to stabilize and the export market is showing signs of coming back a little.

“When prices were high in 2022, there was a very narrow spread in the quality grades,” Callen said. “Now, we are seeing a huge spread between the top-quality hay and lower grades. In the current market, it really makes it worthwhile to put up high-quality hay and protect the stack.”

Callen said that one market that really surprised people this year was corn silage. “Coming off the droughts in 2022, the price for standing corn in the Tulare area shot up to over $100 per ton. By September of this year, the price of standing corn was cut in half, close to $50 per ton. It really depended on when you priced your silage as to how much you paid. Those that locked in their price early in the season paid a lot more than those that purchased closer to harvest,” he noted.

Timothy, another big export product in the Pacific Northwest, experienced price declines by as much as 50%. Callen said there were many fields that got terminated after one cutting and it’s likely we’ll see reduced production in 2023 unless prices rebound somewhat. A lot of timothy was shifted away from the export market and sold into the retail and equine markets.

Overall, Callen said the retail hay market wasn’t impacted by the downturn in prices as much as other markets. For example, retail timothy prices for horses from Nevada’s Diamond Valley only dropped by about 10% in 2023.

Looking to the future, Callen asserted that we need to have milk prices improve and see some improvement in currency exchange rates.

He said that alfalfa acres have been trending down in the West, but he thinks we’ve reached the point where they won’t change too much more. There really are not any other crops that will take alfalfa acres, so he doesn’t see much change there.

Water will continue to be a factor from year to year. Overall, Callen sees some upside in the higher quality grades of alfalfa, but current inventories of lower grades will keep those prices low.